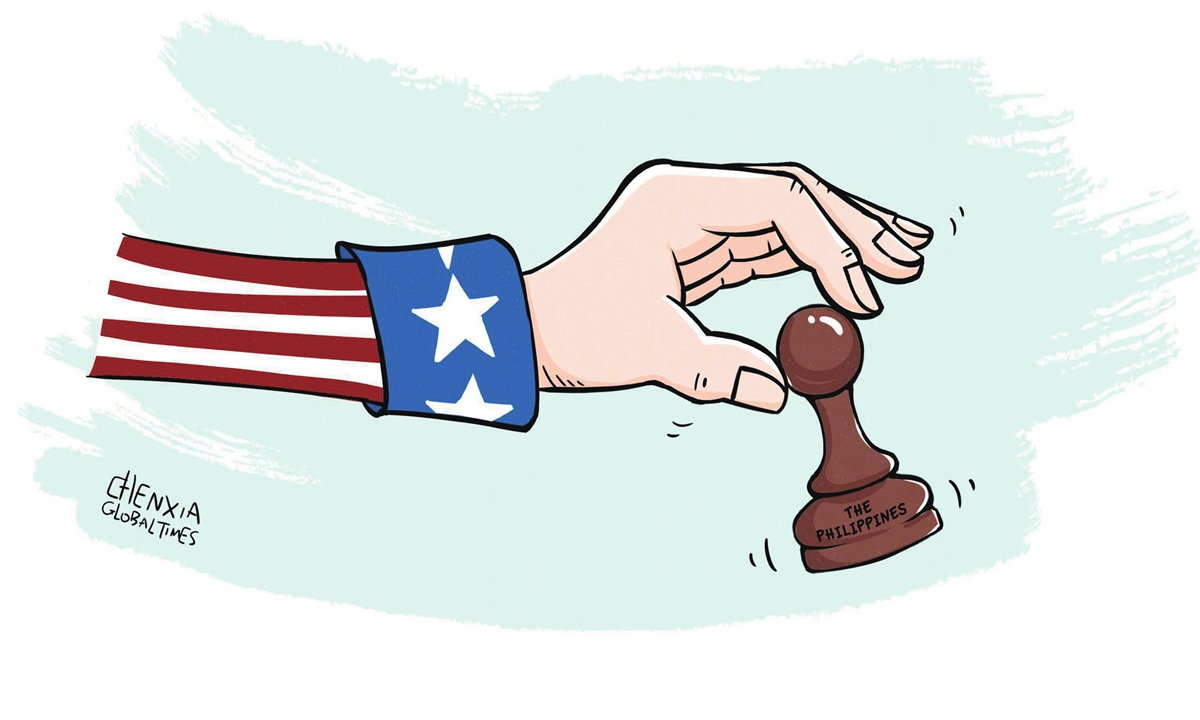

Illustration: Chen Xia/Global Times

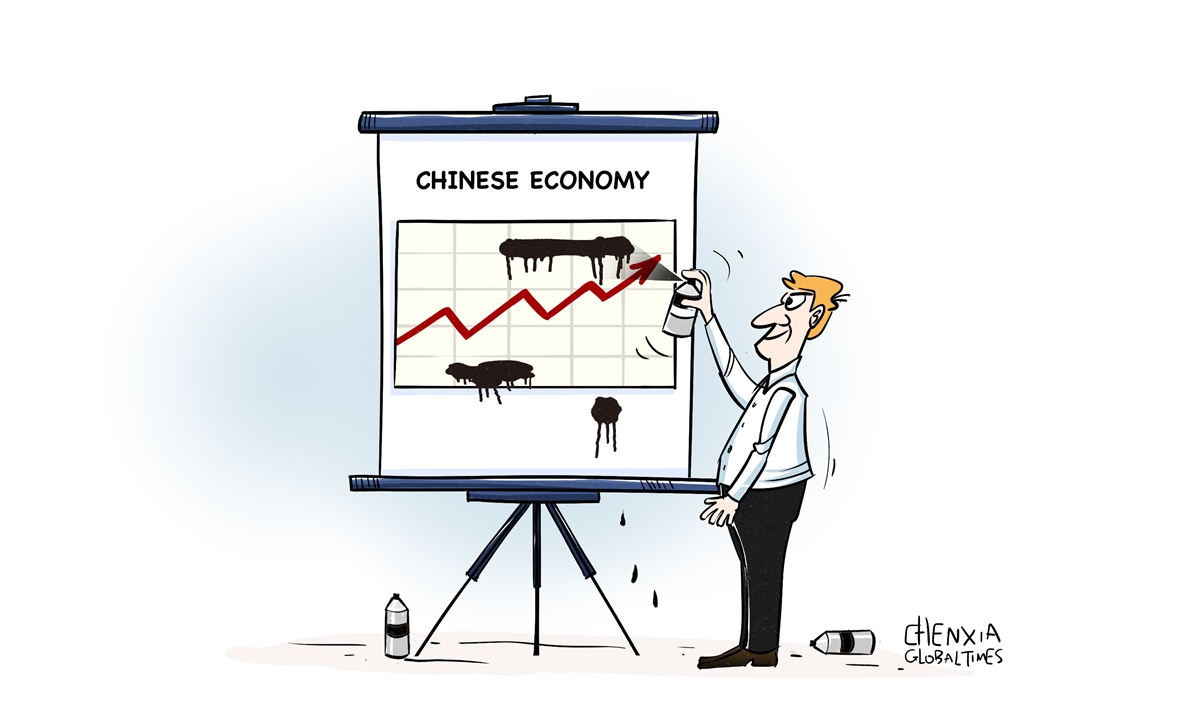

Since the beginning of this year, foreign media outlets and institutions have been throwing mud at the Chinese economy by accusing it of a “lack of transparency in Chinese economic data.” Citing cases of individual Chinese provinces revising data from previous years, they claimed that the revisions were due to a previous falsification.

However, on the other hand, institutions such as the IMF have maintained high expectations for China’s economic growth. For example, in early February of 2024, the IMF released a report predicting that China’s economy will grow by 4.6 percent in 2024. On April 10, Goldman Sachs released a research report raising its forecasts for China’s year-on-year economic growth for the first quarter of 2024 to 7.5 percent and a 5 percent from 4.8 percent for the whole year.

How can we debunk the fallacy of “lack of transparency in Chinese economic data”?

To begin with, China’s economy is currently undergoing a period of structural adjustment, requiring attention to both addressing existing issues and sustaining robust development momentum. It is necessary to consider these two aspects as a whole rather than just looking at one-sided data.

Since 2022, China’s real estate sector has undergone a major adjustment, leading to a continuous weakening of the related industry investment chain and exposing debt risks in some regions or companies. Over the past 20 years, the real estate market has been booming, but the drawbacks brought about by a development model based on high leverage, high debt, and high turnover need to be addressed. Moreover, the interests involved in this industry are very broad.

Even so, at least seven or eight years ago, the government, enterprises, and academia were actively planning for new industries, new models, and new arenas, accumulating a considerable development foundation. Therefore, new growth points have emerged, including new-energy vehicles, lithium-ion batteries, photovoltaic equipment, among others.

In sectors including infrastructure construction, clothing, food, housing, transportation, education, healthcare, and aged care, China’s robust domestic demand market continues to thrive, driven by a sizable population, ongoing urbanization, and rising consumer spending levels – attributes not fully shared by other major economies.

According to the latest statistics, the total number of middle-income individuals in China has exceeded 500 million. China is the world’s second-largest consumer market and second-largest import market, as well as the largest automobile market, consumer electronics market, and online retail market. China’s manufacturing industry accounts for nearly 30 percent of the global total. The robust domestic market cycle, along with a steady export market, provides a solid foundation for the Chinese economy to weather fluctuations in the real estate sector.

The Purchasing Managers’ Index (PMI) for March showed that the PMI has been in the expansion territory for five consecutive months. The Consumer Price Index (CPI) has moderately rebounded, and exports have also increased. This indicates that the Chinese economy is indeed undergoing structural adjustments, and the process of eliminating the dependence on real estate is also underway. The consistent trend of economic stabilization and recovery persists.

Second, the lack of structural research on China’s economic data, confusing concepts, and oversimplified comparisons all contribute to “self-misleading” conclusion of the fallacy of “lack of transparency in Chinese economic data.”

When analyzing economic data, it is important to observe in terms of both amount and structure, as well as the corresponding context. In times of significant economic changes, it becomes even more essential to have structural analysis in mind.

A very typical case is that many foreign media and institutions have claimed that “foreign investment is not coming to China” based on the data from the State Administration of Foreign Exchange (SAFE). In fact, the rules for data statistics by the SAFE and the Ministry of Commerce (MOFCOM) are different, and from the perspective of both the stock and increment of foreign investment in China, the situation is not negative, and there are even some promising aspects. There is no such thing as “lack of transparency in Chinese economic data.”

Taking the foreign direct investment data from the second quarter of 2023. There are differences between the data from SAFE and MOFCOM. In fact, the SAFE data was compiled according to the “asset/liability principle,” while the MOFCOM data was compiled according to the “directional principle.”

Currently, most countries, including China and the US, compile foreign direct investment data based on the “directional principle” because this method can more directly reflect the source of investment and assess the situation of foreign investors entering the country, making it easier for international comparisons.

Generally, foreign direct investment data compiled with the “asset/liability principle” is usually higher than the data compiled with the “directional principle.” However, in recent years, there have been cases where the latter is higher than the former. Regardless of which data is used, it is not accurate to simply say that “Chinese economic data is not transparent” or to conclude that “foreign capital is withdrawing from China.”

Last but not least, foreign media and institutions view the Chinese economy with an ideological bias, deliberately exaggerating and sensationalizing individual cases in an attempt to influence public perception.

Driven by their own sense of superiority, some foreign media and institutions do not accept the reality that the Chinese economy is steadily recovering and can withstand internal and external pressures. They hold biased and skeptical attitudes toward Chinese economic data.

By highlighting the cases of data falsification by some Chinese companies, they magnify external concerns with the aim of influencing the perception of China’s economic governance. In response, we must not only pay full attention to and legally crack down on the falsification of data by individual companies, continuously improve supervision mechanisms, but also firmly counter the narrative of “lack of transparency in Chinese economic data” by some foreign media and institutions.

Currently, the various levels of investigation teams directly under the National Bureau of Statistics (NBS), including provincial, municipal, and county-level teams, are legally conducting data collection and screening, playing a significant role in ensuring the accuracy of data. Based on these data collection efforts, they are cracking down on cases of false reporting, over-reporting, and under-reporting.

For a long time, China’s economic governance and decision-making have been based on seeking truth from facts, relying on data from the NBS to have a full understanding of objectively existing problems. In recent years, a series of specific measures to boost the economy have been proposed based on these data and changes in the internal and external environment. Therefore, China does not have the motivation to “obscure” economic data.

The author is a senior financial observer. [email protected]

Zhou performing at the Chinese Language Day event at the United Nations headquarters in New York on April 18. MINLU ZHANG/CHINA DAILY

Zhou performing at the Chinese Language Day event at the United Nations headquarters in New York on April 18. MINLU ZHANG/CHINA DAILY