Illustration: Liu Xidan/Global Times

Chile has imposed temporary anti-dumping tariffs on Chinese steel products used in the country’s mining industry in a bid to support local producers, Bloomberg reported on Monday, citing a decree published over the weekend.

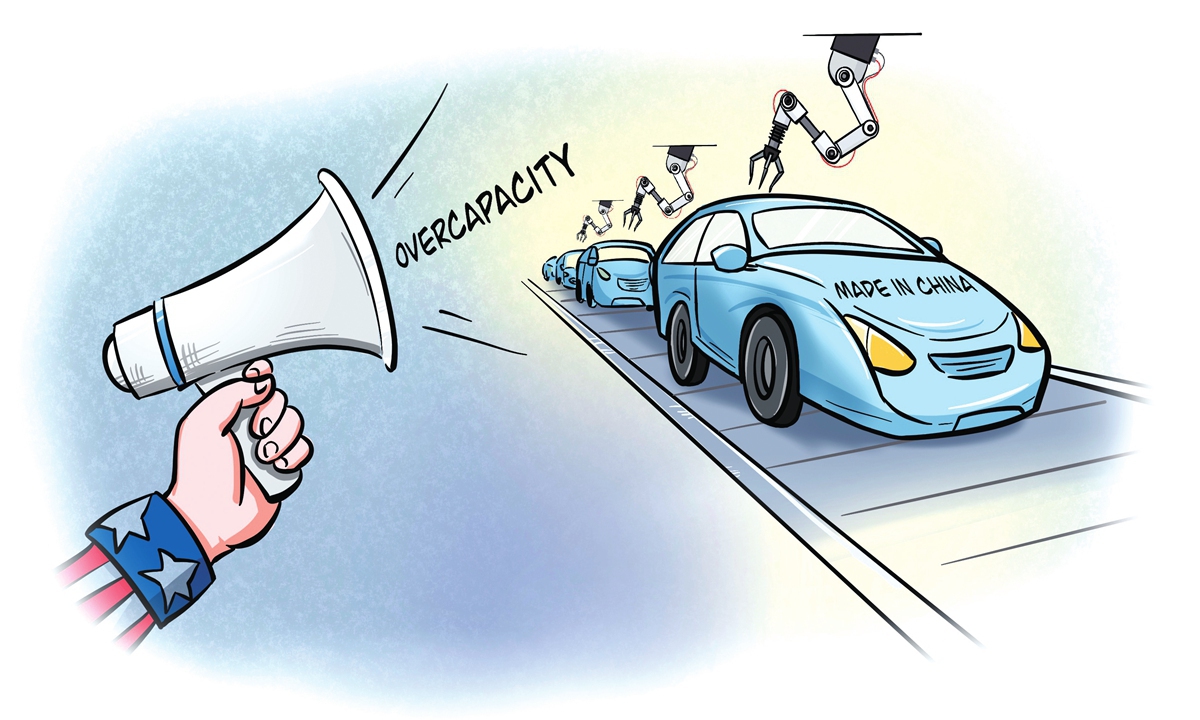

The individual case came at a time when US and European media outlets have unleashed a new wave of criticism and bad-mouthing of China’s economy, raising the alarm about shocks that so-called Chinese overcapacity will have on the global economy.

For instance, a recent report by the Wall Street Journal claimed that “cheap Chinese steel exports have flooded world markets.” Such a climate of opinion is based on groundless accusations and does not hold water.

Overall, the demand for steel products in the Latin American market is on the rise, and local steel companies are struggling to keep up with this demand. The introduction of Chinese steel products into the Latin American market has proven to be beneficial to the economic development of the region. For a long time, Latin American steel companies have faced the challenge of competition from Chinese steel products, which has led to friction in steel trade, and this is not a new problem.

Local anti-dumping measures against Chinese-made goods are not a new problem, either. China has attached great importance to these issues in recent years and has taken steps to address these issues by promoting cooperation, especially by enhancing complementarity or through investment. This is completely different from the US, which has imposed bans on Chinese-made products. The entry of Chinese-made products into developing markets has generally been beneficial to the development of these countries. Moreover, China has never resorted to coercive tactics to achieve the sale of these products, unlike Western powers did in the past.

Western attempts to depict some of China’s most competitive exports as a threat to global markets clearly have ulterior motives. Such hype often ignores the fact that the reason why Chinese products, especially steel, are so competitive in the global markets is because they are not only reasonably priced but also have reliable quality.

When it comes to playing up so-called overcapacity in China, the criticism by Western politicians and media outlets of Chinese products often reeks of protectionism, and conceals an incentive to evade competition with Chinese producers.

What is even more incomprehensible is that some US politicians have criticized Chinese products such as steel and electric vehicles, giving the impression that employment and industries in the US have been significantly affected by Chinese imports. However, the reality is that they have not bought much steel or many electric vehicles from China.

This suggests that there are geopolitical purposes to their economic criticism of China. Their attempt to smear Chinese products and squeeze them out of the global market with the “overcapacity” narrative is aimed at curbing China’s development by weakening the competitiveness of Chinese products.

At a time when the West is unable to provide greener, more affordable and more practical products that align with the needs of the developing world, it is resorting to spreading misinformation about Chinese products in an attempt to hinder developing countries from accessing the necessary resources.

This approach, which highlights Western selfishness and arrogance toward developing nations, is essentially an effort to maintain Western dominance in the global economy by keeping developing countries as suppliers of low-end goods, rather than fostering them as equal partners. This self-serving attitude disregards the pressing need for industrialization and economic diversification among developing countries, an obstacle to the balanced development of the global economy.

Developing countries are facing challenges during their industrialization process, such as access to capital, technology and infrastructure development. In this regard, Chinese products offer a solution by providing raw materials and machinery at competitive prices and with reliable quality, catering to the economic development needs of these nations.

By utilizing Chinese steel, machinery and other industrial goods, developing countries can lower the costs of industrialization and expedite the pace of their industrial growth.

Moreover, China’s collaboration with developing countries goes beyond commodity trade, encompassing manufacturing and infrastructure investments. Frameworks like the Belt and Road Initiative have facilitated extensive cooperation between China and developing nations in infrastructure construction, energy development, transportation and more. This collaboration plays a crucial role in advancing the industrialization and economic growth of developing countries.

In short, Chinese products and investments offer a boost to the industrialization of developing nations. It is imperative for them to capitalize on the opportunity to collaborate with China instead of being carried away by Western narratives.