Consumers browse NEVs at a car fair in Shanghai on March 23, 2024. Photo: VCG

Competition in China’s new-energy vehicle (NEV) industry has intensified as local and international brands rush to announce price cuts and release new models to seek more market share.

Industry analysts said that the fierce competition comes amid the transition of China’s NEV sector from a period of a large number of investments to a mature market, and the entire market will be further concentrated on a couple of leading firms.

Rather than hyping “overcapacity” in China’s NEV sector to contain China’s high-tech development, Western politicians and media outlets should acclaim China’s contribution to the world because the country’s advantages such as continuous innovation, complete industrial chains and full competition have made NEVs cheaper and more popular around the world.

On Monday, Chinese automaker Li Auto announced price cuts of about 5 percent on four of its models and the company said it would refund the difference to owners who bought those models earlier this year.

The move came one day after US automaker Tesla on Sunday trimmed the price of its Model 3 from 245,900 yuan ($34,630) to 231,900 yuan. It now offers the Model Y from 249,900 yuan onward, compared with 263,900 yuan previously, according to the company’s China website.

So far in April, more than 10 NEV brands have reportedly announced price cuts or other promotional activities.

“In the first quarter [of 2024], the number of car models that had price cuts exceeded 60 percent of the number in all of 2023, most of which were NEV models such as all-electric vehicles and plug-in hybrids,” Cui Dongshu, secretary-general of the China Passenger Car Association, told the Global Times on Monday.

This will be a key year for NEV makers to gain a firm footing in China’s auto market, so competition will be extremely fierce, Cui said.

However, he said that Chinese NEV makers will likely have more scope to make a profit this year due to price declines in raw materials like lithium carbonate and economies of scale amid the rapid development of the market.

China’s NEV market is undergoing a structural adjustment from a period when companies made a large number of investments to a mature market, and thus competition has become extremely fierce, Cao Heping, an economist at Peking University, told the Global Times on Monday.

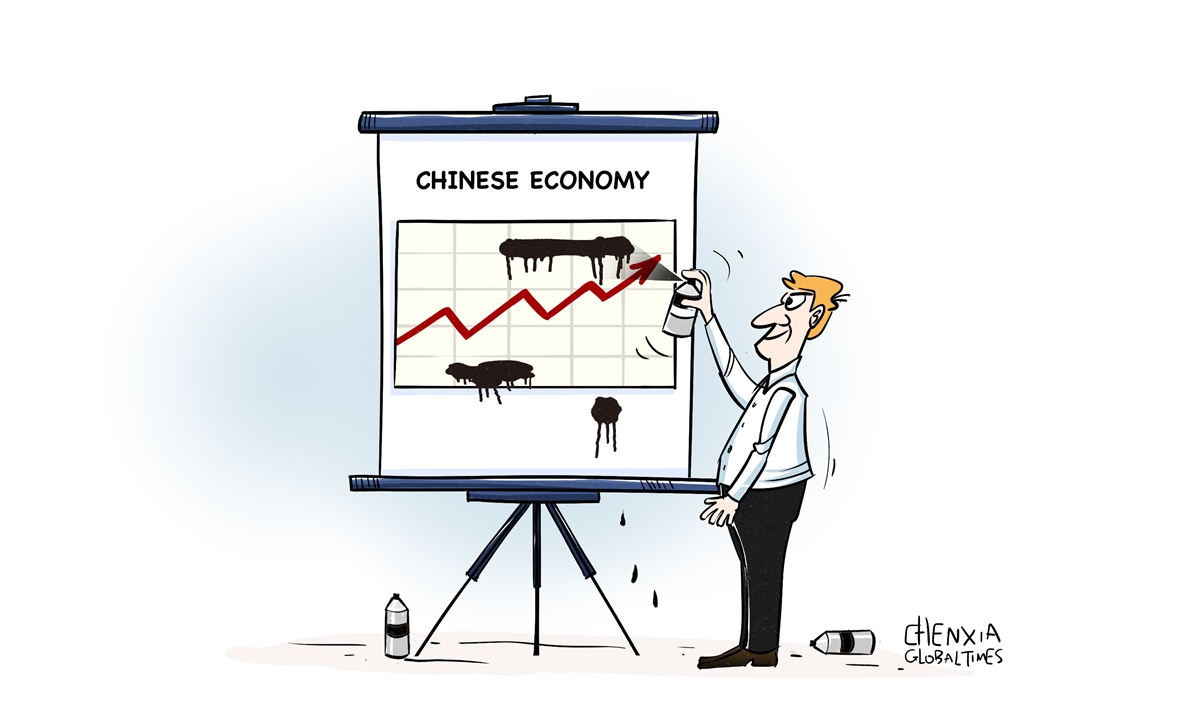

However, this does not mean there is “overcapacity” in China’s NEV sector, and the US vehemently hyping “overcapacity” in the Chinese sector is a political trick to build “a small yard, high fence” around the high-tech sector, Cao said.

“Washington is petty and small-minded,” Cao said. In the 1980s, US companies produced a lot of products like computers and digital devices in China. At that time, the US didn’t blame China for “overcapacity.”

Seeing that China’s industrial chain is climbing from the lower end to the middle and high end today, the US has started to crack down on China by breaking market economy rules, he said.

Washington’s attempt to outcompete China is not benign competition, but vicious competition, in which the US sets traps for the competitor at every turn, according to Cao. He urged the US to maintain an open and cooperative attitude toward China so as to jointly contribute to global technology advance.

China’s vehicle market got off to a good start in the first quarter of 2024, with production and sales each exceeding 6.6 million units, according to the China Association of Automobile Manufacturers. The market share of NEVs remained above 30 percent, the data showed.

Amid the rapid development of the NEV industry in China, the penetration rate of passenger NEVs exceeded 50 percent in the first half of April, as reported by China Central Television on Sunday, outperforming traditional fuel passenger vehicles.

With the approach of the Beijing International Automobile Exhibition on Thursday, domestic automakers have been intensively releasing new models, which are expected to drive up domestic sales in the second quarter.

After a hiatus of four years, the exhibition will see the global debuts of 117 models, including 30 from multinational producers. Exhibitors include international brands like BMW, Mercedes-Benz and Audi, and new car brands like Nio, Xpeng and Xiaomi, according to the official website of the exhibition.

The event, along with policies to support trade-ins, will be a catalyst for domestic car spending, Cui said, expressing positive projections for China’s auto market in the second quarter.